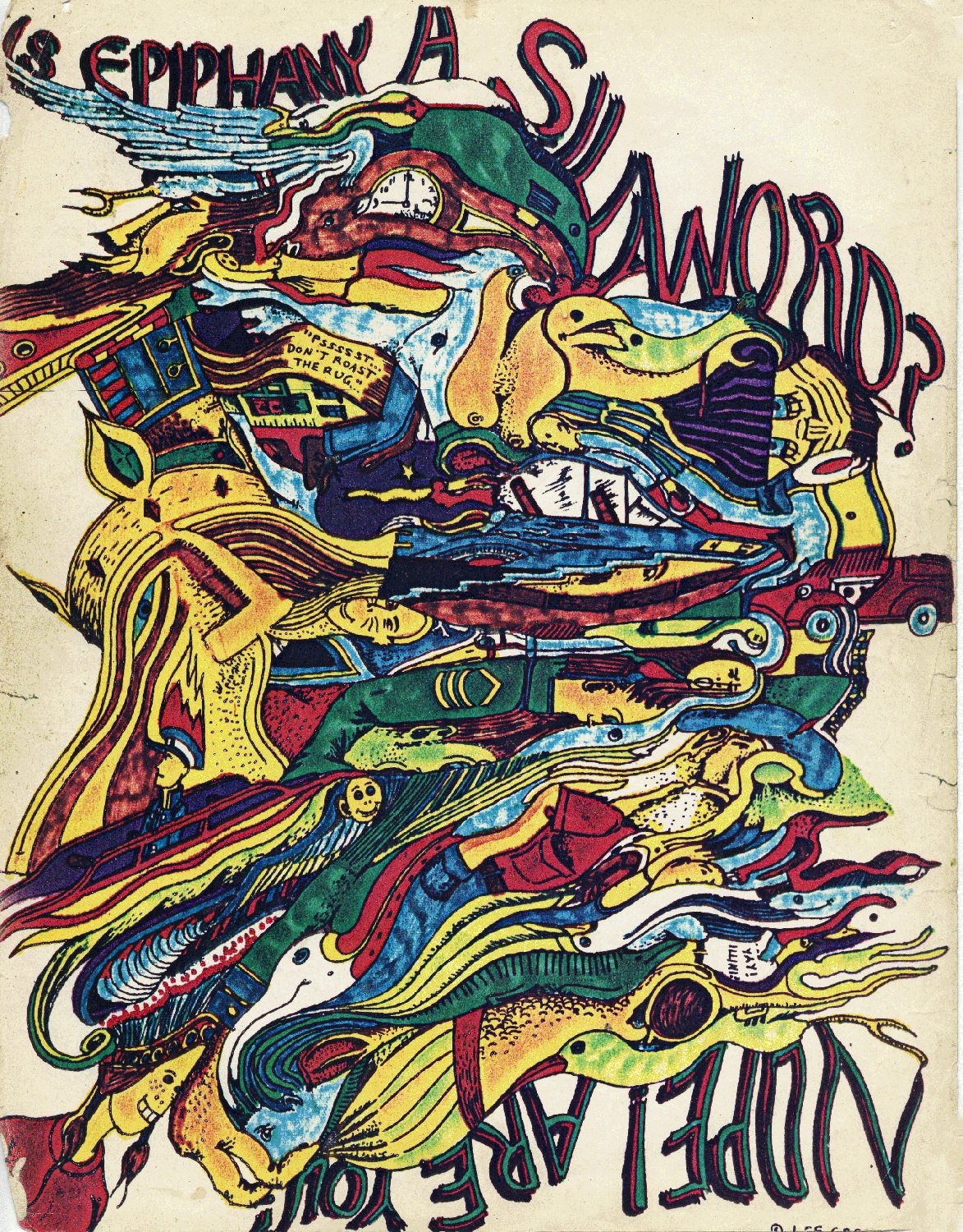

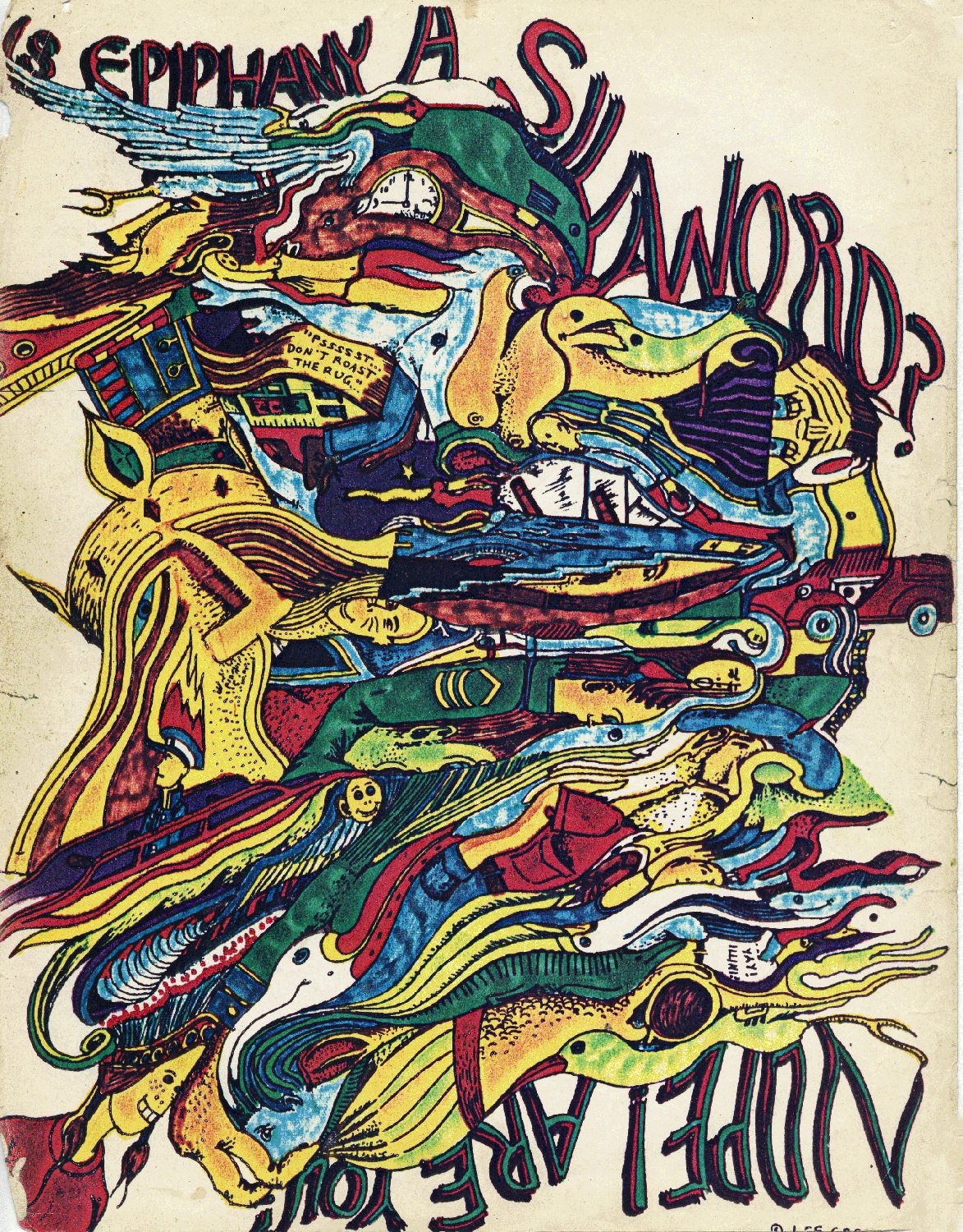

The Cure

for Insomnia

Lee was best known for his epic poem: “A Cure for Insomnia”.

In 1994 the poem was 4,080 pages but now has grown to over 5,700 pages.

Lee was best known for his epic poem: “A Cure for Insomnia”.

In 1994 the poem was 4,080 pages but now has grown to over 5,700 pages.